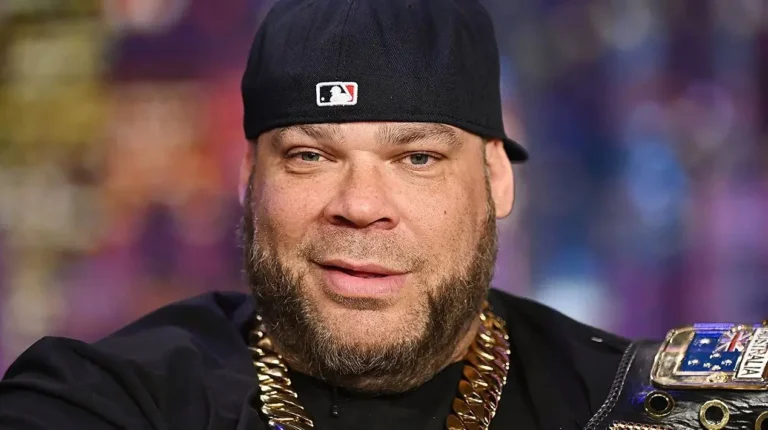

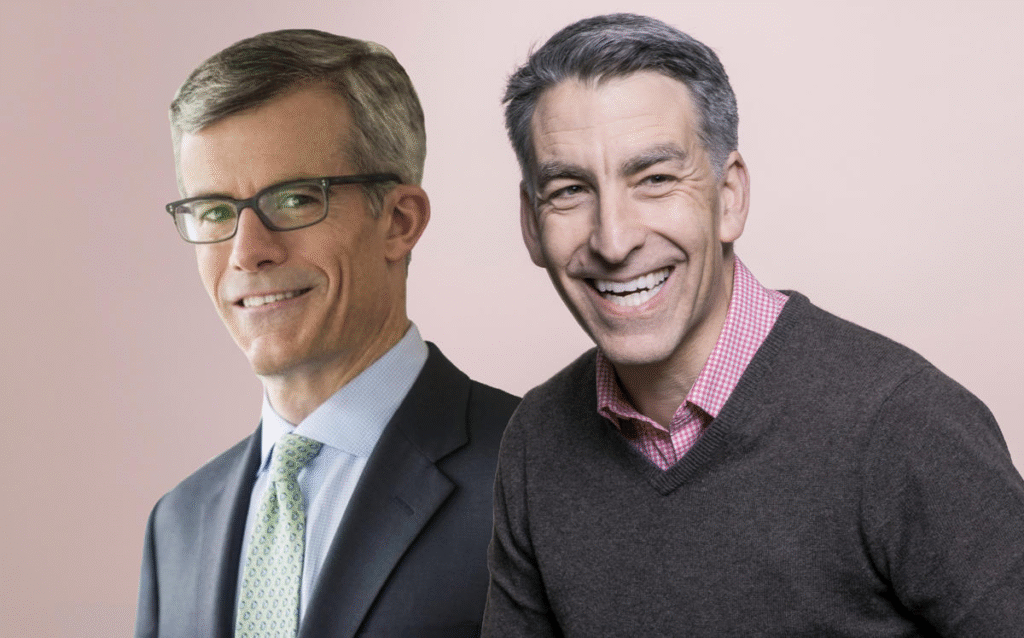

Glenn Kelman Net Worth: Redfin CEO’s Financial Profile

As the long-standing CEO of Redfin, a technology-powered real estate brokerage, Glenn Kelman has established himself as a notable figure in the intersection of technology and real estate. For investors and industry watchers tracking tech executives’ financial success, Glenn Kelman net worth has become a topic of significant interest. This article provides a straightforward examination of his financial standing and the career path that built his wealth.

Glenn Kelman Net Worth in 2025

As of 2025, Glenn Kelman’s net worth is estimated at approximately $70-75 million. This wealth primarily derives from his substantial equity stake in Redfin, the tech-focused real estate company he has led since 2005, along with investments and compensation accumulated throughout his career in technology.

His wealth is primarily composed of:

- Redfin stock holdings (his largest asset)

- Stock options and grants from his CEO compensation package

- Previous earnings from Plumtree Software

- Various investments in other technology ventures

- Real estate and other personal assets

Early Life and Education

Glenn Kelman was born in 1971 and raised in Seattle, Washington. His educational background includes:

- Bachelor’s degree from the University of California, Berkeley

Unlike many tech executives with computer science backgrounds, Kelman studied English and creative writing, bringing a different perspective to the technology industry. This unconventional path would eventually lead to a net worth that places him among successful tech company leaders.

Career Trajectory and Wealth Building

Plumtree Software (1997-2004)

Kelman’s wealth-building journey began when he co-founded Plumtree Software in 1997, serving as Vice President of Marketing and Product Management. Key financial milestones include:

- Helping grow the company to $50 million in annual revenue

- Taking Plumtree public in 2002

- Participating in the company’s eventual acquisition by BEA Systems for $200 million in 2005

This first venture provided Kelman with his initial significant wealth accumulation, reportedly in the single-digit millions, establishing the foundation for his future net worth.

Redfin Leadership (2005-Present)

The majority of Glenn Kelman’s net worth stems from his long tenure as CEO of Redfin, which he joined in 2005 when the company was still in its early stages. His wealth growth accelerated substantially through:

- Pre-IPO Equity: As an early leader, Kelman received significant equity compensation when Redfin was valued at a fraction of its later public valuation.

- IPO Wealth: When Redfin went public in 2017, the company was valued at approximately $1.2 billion. SEC filings indicate Kelman owned roughly 2.7% of the company at that time, instantly valuing his stake at over $30 million.

- Ongoing Equity Compensation: As CEO, Kelman continues to receive substantial stock grants and options as part of his compensation package.

- Salary and Bonuses: While modest compared to his equity compensation, Kelman’s base salary and performance bonuses contribute to his overall wealth.

During his leadership, Redfin has grown from a small startup to a public company with a market capitalization that has fluctuated between $1-5 billion, directly impacting the value of Kelman’s holdings.

You have to read about Laxman Narasimhan Net Worth: What the Starbucks CEO is Worth.

Compensation Structure

Kelman’s compensation package at Redfin is heavily weighted toward equity rather than cash, a common approach for tech company CEOs who believe in their company’s long-term prospects. Recent public filings reveal:

- Base salary around $450,000 annually

- Stock grants and options valued at several million dollars annually

- Performance-based incentives tied to company metrics

This compensation structure aligns Kelman’s personal wealth directly with Redfin’s performance, explaining the fluctuations in his net worth that correspond with the company’s stock price movements.

Stock Holdings and Market Impact

As a public company CEO, Kelman’s net worth experiences significant volatility based on Redfin’s stock performance:

- During real estate market booms, particularly during the post-pandemic housing surge in 2020-2021, his net worth approached $100 million as Redfin’s stock peaked

- Market corrections and real estate downturns have periodically reduced the value of his holdings

- SEC filings show he has diversified some of his holdings through periodic stock sales, typically under pre-arranged trading plans

These planned diversification moves represent prudent financial management rather than lack of confidence, allowing Kelman to lock in gains while maintaining a substantial position in the company.

Business Philosophy and Impact on Wealth

Kelman’s approach to business has directly influenced his wealth accumulation:

- Long-term Orientation: Unlike executives who maximize short-term gains, Kelman has remained with Redfin for nearly two decades, allowing his equity to appreciate substantially.

- Customer-Centric Approach: His focus on improving the real estate transaction process has built Redfin’s brand value and market share, ultimately enhancing his own net worth.

- Transparent Leadership: Kelman is known for unusual candor about company challenges, which has earned investor trust during difficult periods.

- Modest Compensation Philosophy: He has occasionally taken salary reductions during company layoffs, prioritizing long-term equity value over immediate compensation.

Real Estate Holdings

For a real estate company CEO, Kelman maintains a relatively modest personal real estate portfolio:

- Primary residence in Seattle reported to be worth approximately $3-4 million

- No extensive portfolio of investment properties publicly known

- Preference for investing in his company rather than direct real estate investments

This focused approach reflects his confidence in Redfin as his primary wealth-building vehicle.

Comparison to Industry Peers

At $70-75 million, Glenn Kelman’s net worth places him in the middle tier of tech company CEOs:

- Substantially less than tech giants like Satya Nadella (Microsoft) or Sundar Pichai (Google)

- Comparable to other CEOs of mid-sized public technology companies

- Higher than most executives in the traditional real estate sector

This position reflects both Redfin’s status as a mid-sized tech company and Kelman’s significant equity stake as a long-term leader rather than founder.

Public Statements on Wealth

Unlike many executives who avoid discussing personal finances, Kelman has occasionally addressed wealth topics:

- He has been candid about his middle-class upbringing and how it shapes his perspective

- He has advocated for addressing income inequality and housing affordability

- He maintains a reputation for relative modesty despite his multi-millionaire status

These positions reflect a nuanced relationship with his own wealth accumulation while leading a company in an industry directly connected to wealth inequality issues.

Future Wealth Trajectory

At age 54 (as of 2025), Kelman’s financial future remains tied primarily to Redfin’s performance:

- Continued leadership at Redfin could further increase his net worth if the company expands its market share

- The cyclical nature of real estate markets will likely cause ongoing fluctuations in his wealth

- Future technology integration in real estate could either enhance or challenge Redfin’s position

Barring major company setbacks or strategic sales of his holdings, Kelman’s net worth is likely to remain in the multi-million dollar range with potential for significant growth if Redfin continues to gain market share in the massive real estate industry.

Conclusion

Glenn Kelman’s net worth of approximately $70-75 million represents the financial outcome of a successful career spanning software and real estate technology. From his co-founding role at Plumtree Software to his transformative leadership of Redfin, Kelman has built substantial wealth primarily through equity in the companies he has helped build.

For investors and business observers tracking executive success, Kelman’s financial story demonstrates how technological innovation in traditional industries can create significant wealth for leaders who take a long-term approach. As Redfin continues evolving in the competitive real estate technology landscape, Kelman’s net worth will remain closely tied to his company’s ability to navigate industry changes and maintain its competitive position.